From Storefront to SaaS: Asian Retailers Embrace a New Identity – But Will It Click?

The lines between retail and technology are blurring faster than ever. Asian retailers, no longer content with the traditional storefront, are strategically pivoting towards becoming SaaS powerhouses. This isn't a whimsical shift; it's a calculated move to monetize the substantial investments they've poured into building sophisticated technology stacks and supply chain infrastructures. Why limit these assets to internal operations when they can be leveraged to generate new, recurring revenue streams?

This strategic transformation, where retailers adopt B2B SaaS models to offer services like e-commerce enablement, supply chain technology, and digital marketing solutions to smaller brands and fellow retailers, is particularly pronounced across Asia. A perfect storm of converging factors is driving this evolution: the explosive growth of e-commerce markets, the rapid digitization of SMEs, the widespread adoption of cloud technologies, and the rise of data-driven retail operations. This potent combination has created a fertile breeding ground for retail SaaS to flourish. With digital adoption on the rise, Asian retailers are eager to emulate the platform dominance of giants like Amazon, Walmart by offering cost-effective, scalable software solutions to a market hungry for innovation.

This strategic embrace of ‘platform thinking’ is fundamentally reshaping the landscape of retail SaaS innovation across the region. In this blog post, let’s explore how forward-thinking Asian retailers are capitalising on this trend and evolving into SaaS players reshaping the regional retail landscape.

From Retailers To SaaS Vendors

The transformation of retail behemoths into SaaS providers is a global spectacle, with trailblazers like Amazon, through AWS and FBA, and Walmart, with GoLocal and Luminate, demonstrating the immense potential of monetizing internal technology investments.

This model validated a disruptive business concept: that Retail expertise, when properly systematized and packaged, can become valuable technology products in their own right—creating new recurring revenue streams while empowering other businesses with enterprise-grade capabilities.

The allure is undeniable. Traditional retail, often navigating thin and volatile margins, finds a golden opportunity in SaaS solutions. By offering subscription-based services, retailers secure recurring revenue, which is more stable and scalable. SaaS promises higher margins and diversification away from the unpredictable nature of pure product sales, all while leveraging existing infrastructure and expertise to tap into a rapidly expanding market.

In Asia, tech-forward companies like Alibaba, JD.com, Reliance, Flipkart, Coupang, Woolworths and a growing number of others have recognized and capitalized on this growing retail SaaS game. While not every retailer can establish cloud infrastructure on Amazon's scale (barring Chinese giants like Alibaba or JD.com), they're offering a diverse array of specialized services, ranging from dynamic pricing solutions and POS systems to powerful adtech platforms and sophisticated analytics tools, each tailored to the unique needs of the Asian market

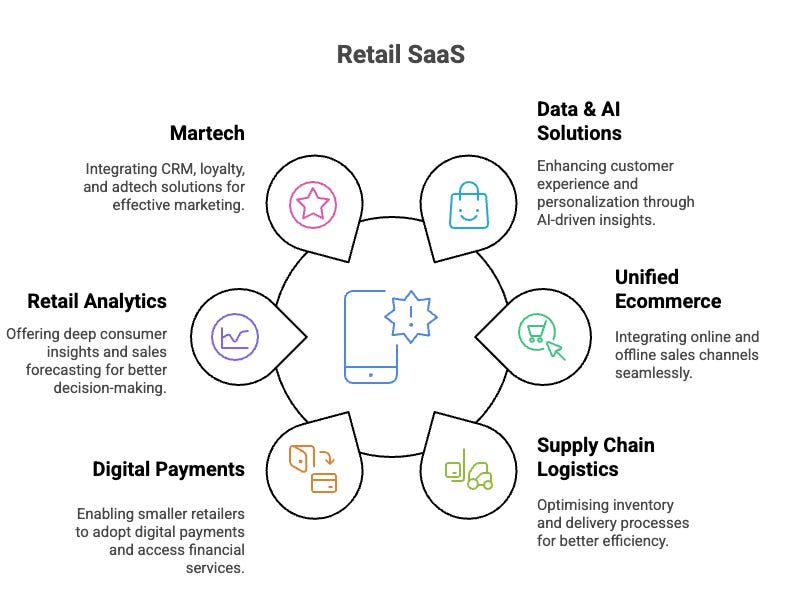

The Retail-to-SaaS Shift: Five Functional Frontiers

As retailers make their moves, we can cluster this shift in 5 key functional domains, each representing a critical area where retailers are leveraging their expertise and technology to empower others

1. Data & AI Powered Solutions

Given that data is the ultimate currency, this is usually the first road retailers are taking towards building their SaaS offerings. They are providing smaller merchants with access to sophisticated data and AI/ML solutions, once the exclusive domain of large corporations. These SaaS solutions integrate data from both online and offline channels, harnessing AI and ML to analyse customer behavior, optimize inventory, and tailor marketing including pricing & promotion strategies in real time.

A great example would be Woolworths Group—a leading retailer in Australia and New Zealand—which has been at the forefront of this transformation. In 2021, Woolworths acquired a controlling stake in Quantium and established Woolies iQ (wiq) to develop joint advanced retail analytics capabilities to transform customer and supplier experiences. While initially deployed across Woolworths' extensive ecosystem, they have now commercialised these capabilities, offering it to retailers worldwide.

2. Unified Ecommerce Solutions: Integrated digital ecosystems.

Unified e-commerce solutions are another fertile ground for innovation. These comprehensive offerings encompass omnichannel retail platforms, modern Point of Sale (PoS) systems, and robust e-commerce enablement tools.

India's Reliance is a prime example of a retailer leveraging its technological investments to build an expansive digital ecosystem. A key part of this vision involves digitizing traditional Kirana stores through JioMart, its ecommerce platform. At the same time, Reliance also offers SaaS-based solutions through its Jio Commerce Platform, which provide comprehensive order management, catalog management, marketing and promotional, and data analytics tools.

Another Indian online retailer that has evolved as a SaaS player is Flipkart. Its Flipkart Commerce Cloud offers a range of solutions ( digital commerce, retail media platform, pricing engine etc) helping store owners connect their online and offline operations. These cloud-based services are flexible, allowing retailers to choose what works best for them.

3. Supply Chain Logistics & Fulfillment SaaS: Backbone of Retail

A robust and efficient supply chain is fast becoming the linchpin of success in Asian retail. As a result, retailers with strong logistics capabilities are monetising it by offering supply chain and fulfillment SaaS solutions covering warehousing, delivery, and last-mile logistics.

For instance, South Korea’s Coupang provides comprehensive logistics services through its subsidiary, Coupang Logistics Services (CLS). Their offerings are designed to support both large brands and SMEs, facilitating efficient order fulfillment and last-mile delivery.

Yet another example of a retailer-cum-logistics and fulfillment SaaS is India’s food delivery company Swiggy. Through its subsidiary, Scootsy Logistics, Swiggy is now extending its expertise to other businesses offering warehouse management, in-warehouse processing, and order fulfillment as SaaS solutions.

4. Digital Payments & Fintech SaaS: Powering financial inclusion

Retailers are increasingly offering Fintech SaaS solutions, driving financial inclusion by enabling smaller businesses with accessible digital payment systems and crucial financial services. By providing access to digital payment gateways, microloans, and investment opportunities, retailers are fostering frictionless customer experiences that build loyalty and boost sales.

In India, PhonePe, initially launched within Flipkart and subsequently spun off as an independent entity, has become a dominant player. PhonePe offers a comprehensive suite of merchant services, including payment gateways, POS solutions, QR code payments, and business loans, enabling even the smallest retailers to participate fully in the digital economy. While now independent, PhonePe's origins within Flipkart highlight how major retail platforms can leverage Fintech to expand their ecosystem and empower their merchant partners

5. Martech Capabilities: Democratizing Advanced Marketing

These SaaS offerings offer smaller businesses enterprise-level capabilities across MarTec, including CRM, digital loyalty programs, social commerce tools, and advanced adtech platforms.

Japanese e-commerce giant Rakuten stands as a prime example of this trend. Evolving from its roots as an online marketplace, Rakuten has developed a comprehensive suite of digital services, notably the Rakuten Advertising Platform. which provides a range of marketing and advertising solutions. Similarly, as mentioned earlier, FlipKart offers Retail Media Platform capabilities as a SaaS offering as well.

Will this bold vision work?

The pivotal question remains: Will this ambitious strategy succeed for Asian retailers? While the opportunities are undeniably compelling, there are also significant challenges and the answer, as always, is nuanced and depends heavily on execution.

Retailers, traditionally rooted in product-centric and operational paradigms, often lack the inherent "SaaS DNA" required for success. They face fierce competition in a saturated SaaS market and must navigate the complexities of balancing transactional retail with subscription-based models. Building scalable SaaS platforms often demands substantial investment, and establishing credibility as a trusted technology provider, distinct from their retail brand, is not easy.

However, retailers possess a unique set of advantages. Biggest of them all is their domain understanding of retail operations which allows them a powerful value proposition. Having experienced the pain points firsthand, retailer-SaaS vendors can build products that address real-world challenges with practical, relevant features. In addition, retailers are data goldmines, which gives them a distinct competitive advantage given their insights into consumer behaviour, preferences and trends that extend far beyond basic transaction data.

However, for this transition to SaaS platforms to be successful, retailers must take several strategic actions to position themselves for success in the SaaS market.

Developing a clear value proposition that leverages their unique perspective is first and foremost. By identifying specific niches where their retail background provides advantages, retailers can create compelling differentiation in the market. This targeted approach allows them to compete effectively against broader platform providers.

Of course, investing in dedicated SaaS expertise and building secure & scalable technology foundations is essential. This means hiring talent with proven experience or forming strategic partnerships with established technology companies.

The relationship-based nature of SaaS differs from transactional retail, requiring a shift in mindset. But beyond operational and mindset changes, retailers planning a SaaS business must effectively communicate their dual identity as they build trust as a tech provider. This careful brand management is critical to allow them to leverage their retail credibility while establishing a reputation in the SaaS marketplace.

Asian retailers venturing into SaaS is both a fascinating and potentially disruptive trend. This is more than just a shift in business models; it's creating a more innovative and interconnected industry where specialised knowledge translates into technological solutions benefiting the entire sector.